puerto rico tax incentives 2021

Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050.

Investors Are Relocating To Puerto Rico For Its Savings On Individual And Corporate Taxes By Francesca Maglione From Crypto For Bloomberg

The 36-year-old who has been involved in the crypto.

. Regulations from the Internal Revenue Code of 2011 are also applicable to corporations. In March 2021 crypto entrepreneur and investor David Johnston moved his parents wife three daughters and company with him to Puerto Rico. In April 2021 Biden freed up nearly 8 billion in disaster-relief funding for Puerto Rico and in July his administration revived the White House Puerto Rico.

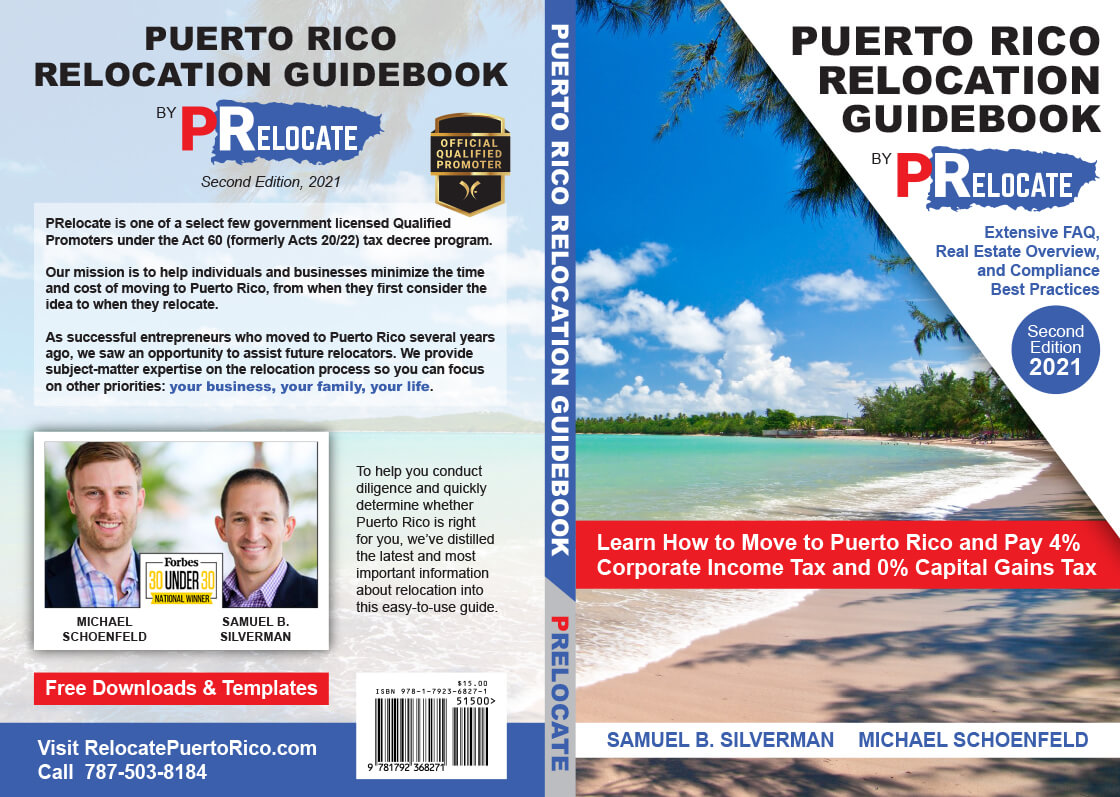

Payment for services rendered in Puerto Rico by Entities Doing Business in Puerto Rico duly registered in Puerto Rico State Department. Any natural or legal person doing business in Puerto Rico who makes payments Payer for rendered services must. To help with your diligence weve distilled the latest and most important information about Act 60 Act 20 and Act 22 and the relocation all in one place for easy consumption so that.

Puerto Rico corporations are governed by the Puerto Rico General Corporations Act of 2009. Kenya is located along the Indian Ocean on the East coast of Africa and is bordered by Tanzania to the south Uganda to the west South Sudan to the northwest Ethiopia to the north and Somalia to the northeast. 92 For fiscal year 2021 July 2020June 2021 about 3 of PREPAs electricity came from renewable energy.

Solar energy wind energy hydropower and biomass. Puerto Ricos renewable resources include. Sovereign Man More Freedom.

The two principal pieces of tax legislature which make Puerto Rico attractive as a tax haven are Act 20 Export Services Act and Act 22 Individual.

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

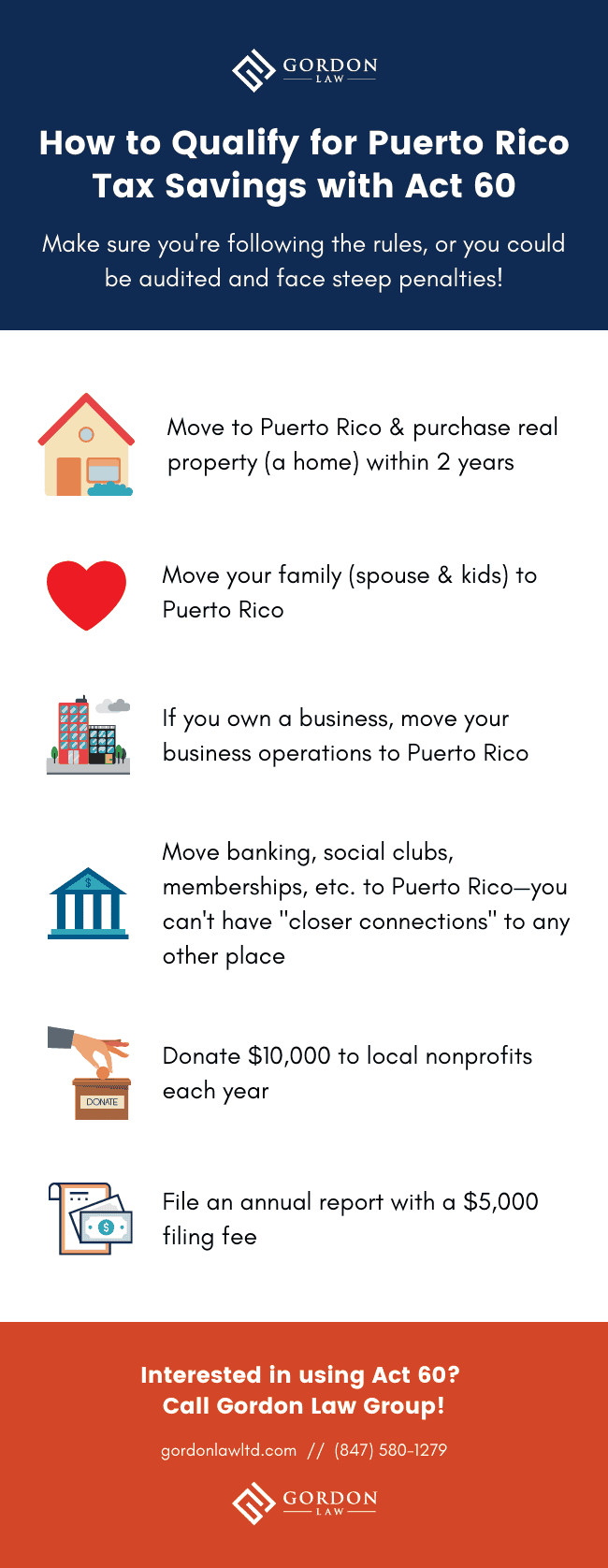

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

![]()

Puerto Rico Investors Conference

A Red Card For Puerto Rico Tax Incentives

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Guide To Income Tax In Puerto Rico

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax And Incentives Guide Grant Thornton

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

Guide To Income Tax In Puerto Rico

Us Tax Filing And Advantages For Americans Living In Puerto Rico

4 Business Opportunities In Puerto Rico Biz Latin Hub

Overview Relocate And Move To Puerto Rico With Act 20 Act 22

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business